BY N PRASHANT CHOWDARY

You pay 50 times earnings for a company that grows 15% a year, you need almost 20 years of that growth just to break even on your original investment. The P/E ratio of any company that’s fairly priced will equal its growth rate. Anything higher and you’re paying for hope.” – Peter Lynch

“If the P/E is low, you don’t need high earnings growth to get the same upside. The multiple expansion on the low P/E stock towards a more normal P/E will provide a big chunk of the return.” –John Neff

Investors consistently pay 50-100 times earnings for companies growing earnings at 20-25% a year, assuming that growth will continue indefinitely. History shows that almost no company can compound earnings at those rates for more than 8-10 years. When the inevitable slowdown comes, the multiple contracts sharply and the stock plummets – often by 70-90%.” – David Dreman

ETERNAL LIMITED: P/E RATIO:1589

A food delivery company has P/E ratio of 1589. Everyone in the houses should stop cooking food and order from Zomato to sustain these levels of p/e to increase its revenue

Trent limited: P/E RATIO :95

Even after stock has fallen by 47 percentage from its all time high it still has a P/E ratio of 95. At the peak of the price stock p/e went to 527 for a simple cloth shop ZUDIO.

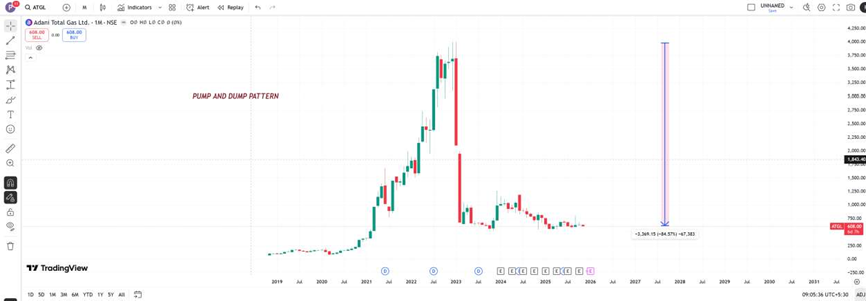

ADANI TOTAL GAS: P/E RATIO :107

For its competitor a government owned company Petronet Lng Ltd its p/e ratio is 11.2. Gas is a classic pump and dump scheme.

AVENUE SUPERMARKET LTD: P/E RATIO 96.2

The famous Dmart which has an operating margin of 6-7 percentage on the daily essentials on the human need has once reached 313.9 pe ratio and now it is slowly eaten away by dark stores.

If you look in to the rear-view mirror. Markets are supposed to reflect expectation of the future returns. When GDP of India grows at 6.5 percentage points, revenues of nifty 50 companies rose a mere 7 per cent, operating profits grew 13 percent, and net profit by just 9 per cent. How can the stock justify high p/e ratio?

THANK YOU.